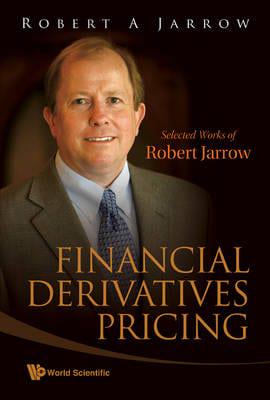

Publisher's Synopsis

This book is a collection of original papers by Robert Jarrow that contributed to significant advances in financial economics. Divided into three parts, Part I concerns option pricing theory and its foundations. The papers here deal with the famous Black-Scholes-Merton model, characterizations of the American put option, and the first applications of arbitrage pricing theory to market manipulation and liquidity risk.Part II relates to pricing derivatives under stochastic interest rates. Included is the paper introducing the famous Heath-Jarrow-Morton (HJM) model, together with papers on topics like the characterization of the difference between forward and futures prices, the forward price martingale measure, and applications of the HJM model to foreign currencies and commodities.Part III deals with the pricing of financial derivatives considering both stochastic interest rates and the likelihood of default. Papers cover the reduced form credit risk model, in particular the original Jarrow and Turnbull model, the Markov model for credit rating transitions, counterparty risk, and diversifiable default risk.